U.S. Student Loan Debt Soars to $1.6 Trillion

The total student loan debt in the U.S. has now reached $1.6 trillion, according to a quarterly report recently released by the Federal Reserve.

As of January, National debt from student loans exceeds that from auto loan debt by over $300 billion.

The average student loan debt per borrower in the U.S. is just over $29,000, according to the Institute for College Access & Success.

Steve Black, Ph.D. and Chair of Finance at the University of Central Oklahoma said students and their families should focus on financial planning, first asking themselves how much they might earn upon graduation.

“If you go in for a car loan, you have to know what your budget is,” Black said. “Students are borrowing without a clear expectation of potential earnings.”

Sally Mae reports that 8 out of 10 families use scholarships and grants. Over half of families take out loans to cover the cost of school. These findings show that family savings and income alone are not enough for most families.

UCO alumna Kristina Jones took out loans to pay for her B.F.A in Education, as well as her first masters in Guidance and Counseling.

To her, taking out loans was the only option.

“Without them I never would have been able to go to college. Growing up, between all my siblings and life in the lower middle class, my parents couldn’t and didn’t set aside some nice a nest egg,” Jones said. “In fact, I didn’t even go to college my first semester out of high school, because I had no idea about student loans, no guidance on how to pay for college, or fill out a FAFSA application.”

Jones said she eventually went to the financial aid office at UCO, asked what forms she needed for student loans and began the process.

She is just one of more than 43 million Americans that have student loan debt, which translates to one in six adults in the U.S.

“Every semester, every year I had to take out student loans if I wanted to go to school,” Jones said. “I worked throughout school the entire time and all of my earnings went to bills and daily learning, so you can imagine the debt I am facing now and forever.”

When Jones completes her masters in professional counseling with an LPC, she expects her debt to easily exceed $100,000. She said companies are already trying to scam her by buying her debt and charging high interest.

“They say ‘we can lower your rates’ or ‘we have your current loans’ or whatever, but it is never true. It gets very tricky to navigate, and because I started another degree, they are put in a state of forbearance,” Jones said. “I pay nothing now, but interest continues to grow, or, that is what has been explained to me, at least.”

When a borrower can’t make payments, they can delay the repayment process through forbearance or deferment. As of quarter four in 2019, Jones is part of the 6.4 million loan borrowers currently in forbearance or deferment.

The difference between deferment and forbearance is the former does not accrue interest on Federal Grad PLUS, Federal Stafford and Federal Consolidation Loans. In forbearance, the government will not pay the interest, which is generally used when the borrower is unable to qualify for deferment.

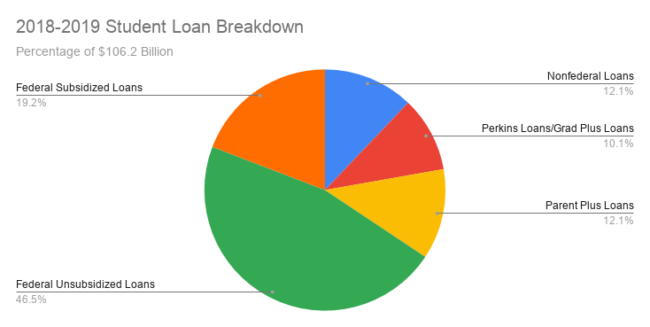

According to the Federal Student Aid Data Center, students took out over $106 billion dollars in loans for the 2018-2019 school year.

Federal unsubsidized loans make up the largest percentage of loans taken out.

Private/Nonfederal loans, which accounted for 12 percent of student loans for the 2018-2019 year, make up nearly 8 percent of all outstanding student loan debt. History shows these loans generally carry a higher interest rate.

“Interest rates on private loans can reach as high as 17 percent,” Congresswoman Kendra Horn said at a town hall at UCO on Jan. 23.

On July 17, 2019, Horn introduced HR 3793, the SLASH (Student Loan Accrual Support and Help) Act to address interest rate accrual. Under this legislation, loan providers would be capped at 5 percent interest.

Horn said this is a reasonable interest rate that would cover the cost of servicing the loans as well as the debt, while ensuring that a borrower doesn’t end up paying two or three times what the 10 year treasury rate is.

A report on the Economic Well-Being of U.S. Households in 2018 – May 2019 by the Federal Reserve reveals that 54 percent of people who went to college took on debt.

UCO students average $27,456 in loan debt, less than the national average according to CollegeFactual.

Horn said in the past six years, 2 million people have defaulted on student loans.

Defaulting on a loan means there was a failure to repay according to the terms laid out in the promissory note. Students are default on a loan when they have failed to make a payment for over 270 days.

Horn introduced HR 4869, the Student Loan Default Reduction Program Act in Oct. 2019 for people who have gone into default, but have been active in loan counseling and are trying to get back on track.

“Under current law what happens is they go through that rehabilitation, but their credit is still damaged according to their report,” Horn said. “This bill would require all student loan service providers to erase all adverse credit history after those borrowers have taken the steps to get back on track with their payments.”

Horn said these bills are forward thinking, but there is still much work to be done.

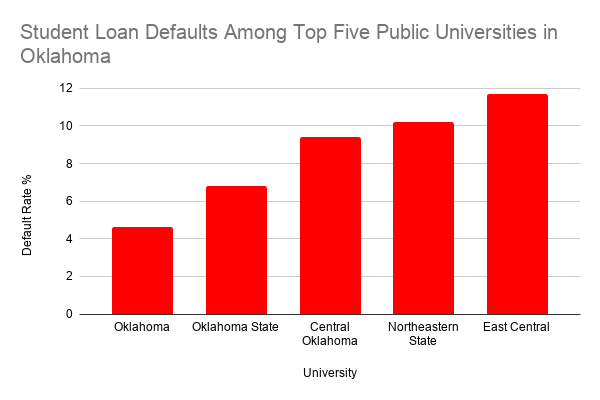

UCO graduates have the third highest default rate at 9.4 percent among the top five public universities in the state of Oklahoma and exceed the national average of seven percent.