U.S. adopts debt protection rules for college students

Madison Simon

Contributing Writer

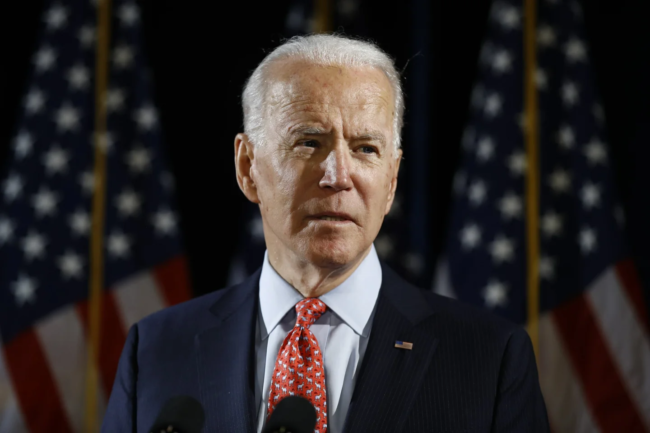

College students are set to receive unprecedented protections against debt thanks to new regulations introduced by the Biden-Harris Administration.

The U.S. Department of Education released the final rules for the Gainful Employment (GE) program on Sept. 27. The modifications made were designed to shield approximately 700,000 students each year from postsecondary programs that could leave them drowned in debt or with earnings that don’t measure up.

At its core, the GE rule requires private for-profit institutions and certificate programs to meet certain standards. Specifically, the debt students incur should be comparable to their earnings after graduation. The “debt-to-earnings ratio” is defined in the regulations, the annual earnings a typical graduate must allocate to repaying their debt must not exceed 8% of their overall earnings or 20% of their discretionary income.

Furthermore, the rule has an “earnings premium” feature that mandates at least half of a program’s graduates to have a higher earning than a typical high school graduate in their state

who didn’t pursue postsecondary education. Not meeting these standards could result in a program losing access to federal student aid.

“Today’s final rules answer President Biden’s call to hold colleges accountable for rising costs and protect students from unaffordable college debt.” said U.S. Secretary of Education Miguel Cardona.

He further emphasized the importance of informing students about programs that historically lead to high debts, insufficient earnings, and diminished career prospects.

“The Biden-Harris administration believes that when students invest in higher education, they should get a solid return on their investment and a greater shot at the American dream,” Cardona added.

Complementing the GE rule is the Financial Value Transparency (FVT) framework, ensuring students receive comprehensive information about the net costs of postsecondary programs and potential financial outcomes. This framework will not only inform students about the likely costs and debts they may accumulate but will also introduce an acknowledgment mechanism, ensuring students are aware of the risks associated with certain programs.

U.S. Department of Education Under Secretary James Kvaal emphasized the broader objectives of these measures.

“Students overwhelmingly say that they’re going to college to find a good job and build financial security, but too often their programs leave them no better off financially than those with no postsecondary education at all. These rules will stop taxpayer dollars from going to schools that continually saddle students with unaffordable debt. Separately, we’re ensuring all students have increased information to make good choices.” said Kvaal.

The Department of Education estimates nearly 1,700 low-performing programs will be affected by these rules, impacting around 700,000 students who might otherwise enroll in these programs. When combined with the GE regulations, the FVT framework will result in acknowledgements for around 400 graduate programs enrolling about 120,000 students.

In a wider perspective, these regulations are an initiative of the Biden-Harris Administration aiming to maintain postsecondary education as a means for equal opportunity, upward movement, and international competitiveness. The administration has sanctioned over $117 billion in student loan relief for upwards of 3.4 million borrowers and advocates for enlarged Pell Grants and the concept of tuition-free community college.

This decision follows a thorough review of over 7,500 public comments received during the summer. The rules will come into effect on July 1, with the first official financial outcome rates expected to be published in early 2025. Any programs failing the same GE standard in the first two years of these rates will face ineligibility in 2026.

The new Gainful Employment rule modifications emphasize transparency, accountability, and financial security.